Over the last two decades, India has seen a big push towards financial inclusion. Having a bank account can be the first step, allowing account-holders to receive welfare benefits, save, borrow and invest.

There are now nearly 2.5 billion bank accounts held by individuals in India, as reported by banks[1]. These numbers can include multiple accounts held by the same person, but exclude institutional accounts such as those owned by corporations or trusts.

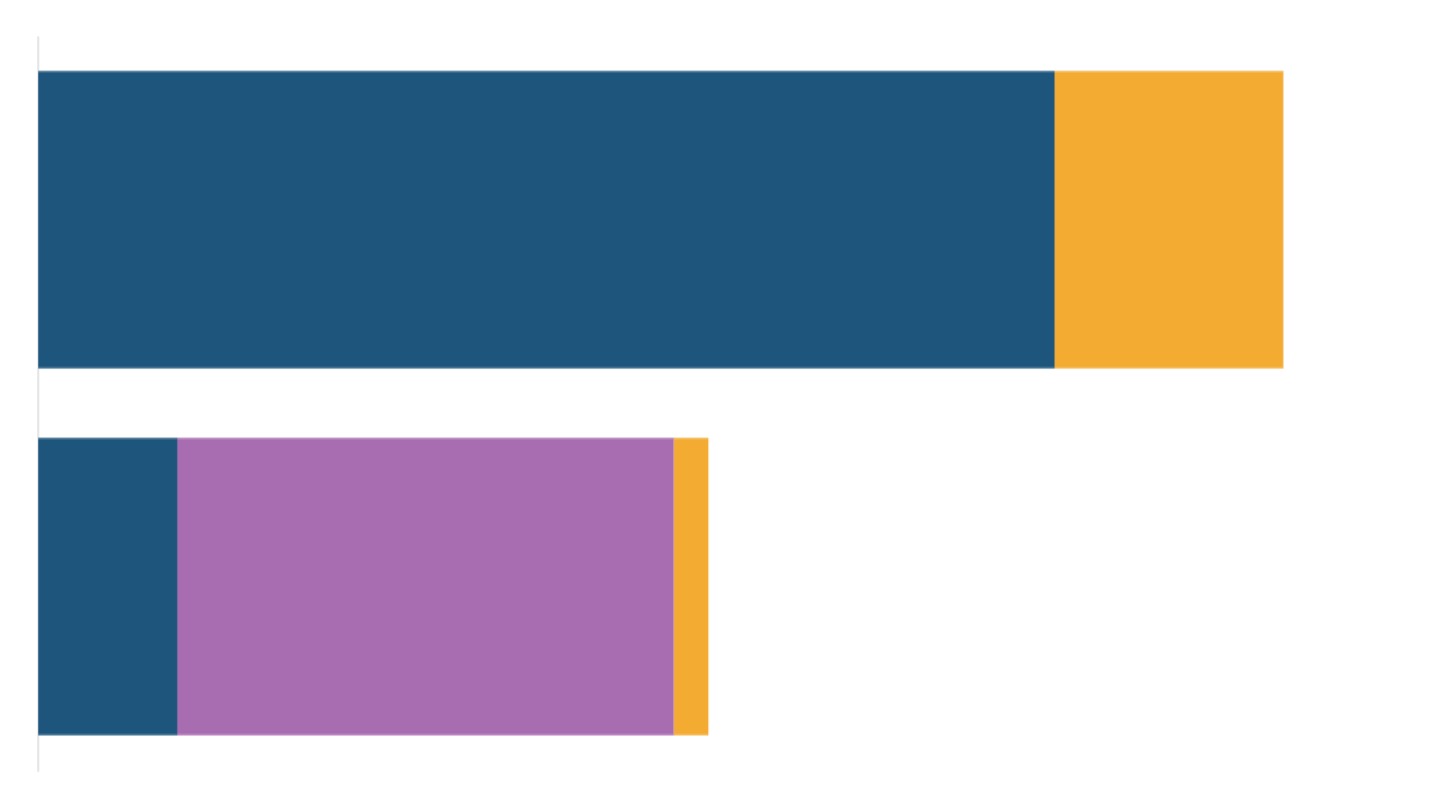

Indian men hold 50% more bank accounts than women.

Bank account penetration

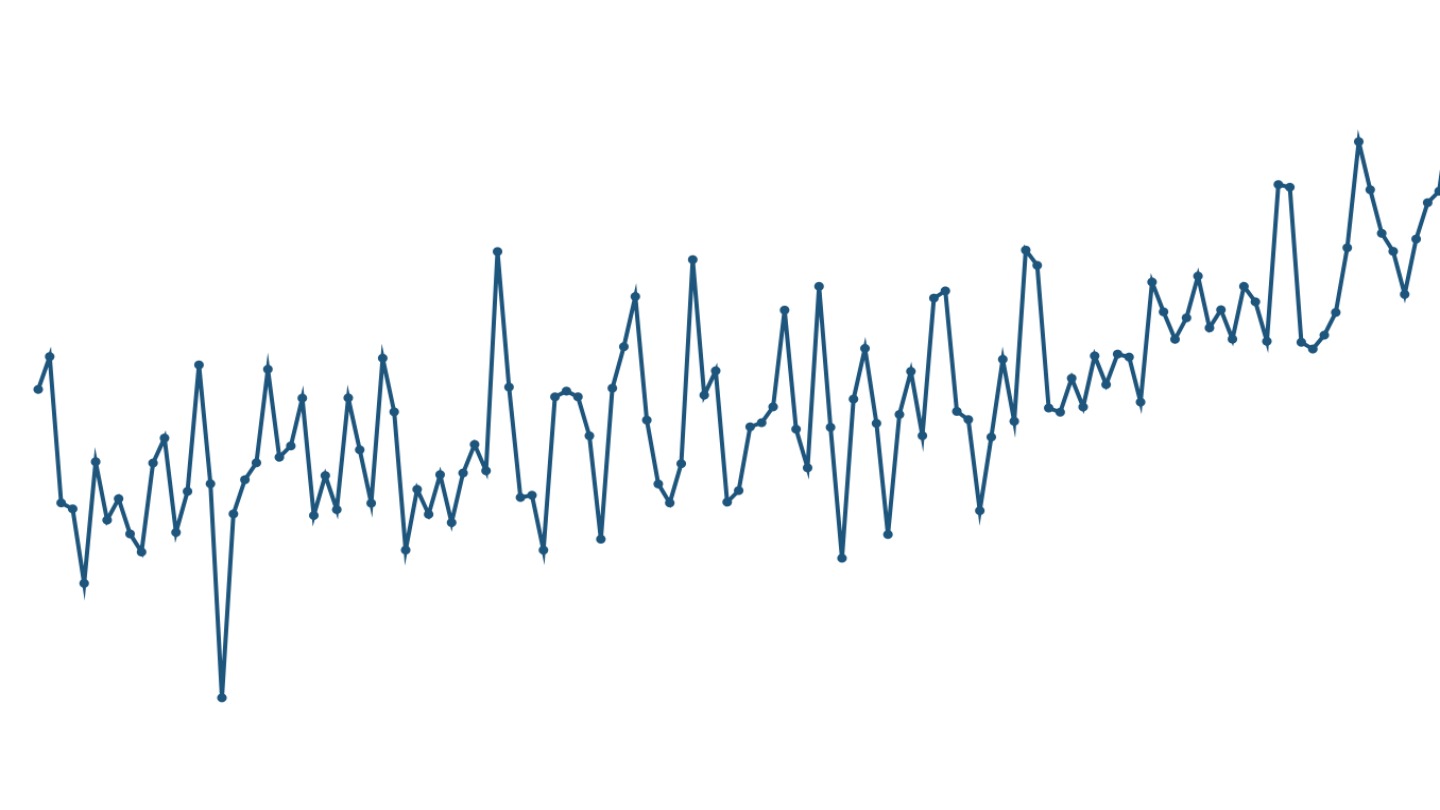

Nearly every Indian household now has a bank account.

India's National Family Health Surveys have since 2006 recorded if the surveyed households had at least one member with an account with a financial institution such as a commercial or cooperative bank, or a post office. They find that from fewer than half of Indian households having a bank account in 2006, 96% of households had a bank account by 2021.

Even at the individual level, over nine in ten adult Indians now report having a bank account.[2] Access to a bank account is high across income groups; even among the poorest 20% of Indians, nine in ten now have a bank account.[3]

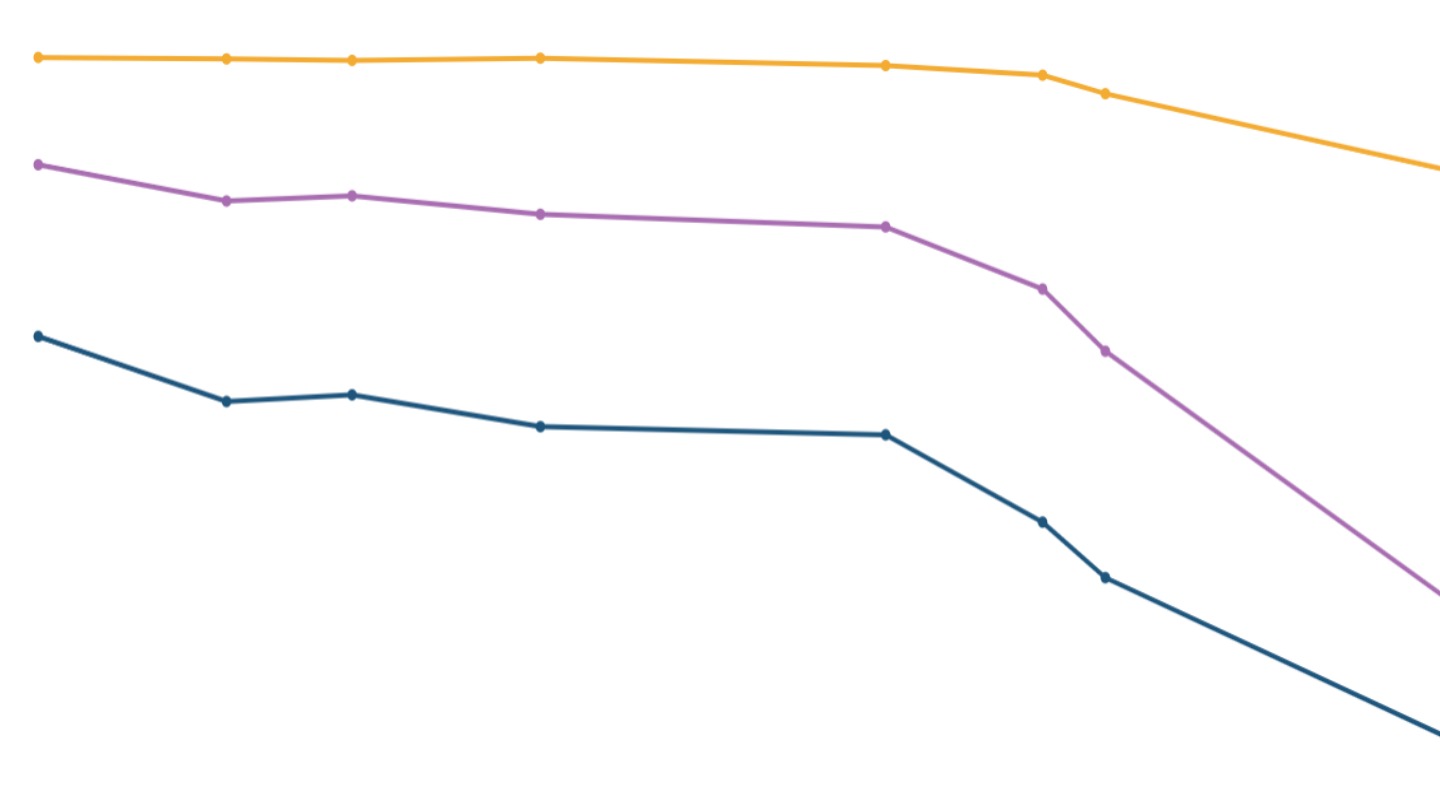

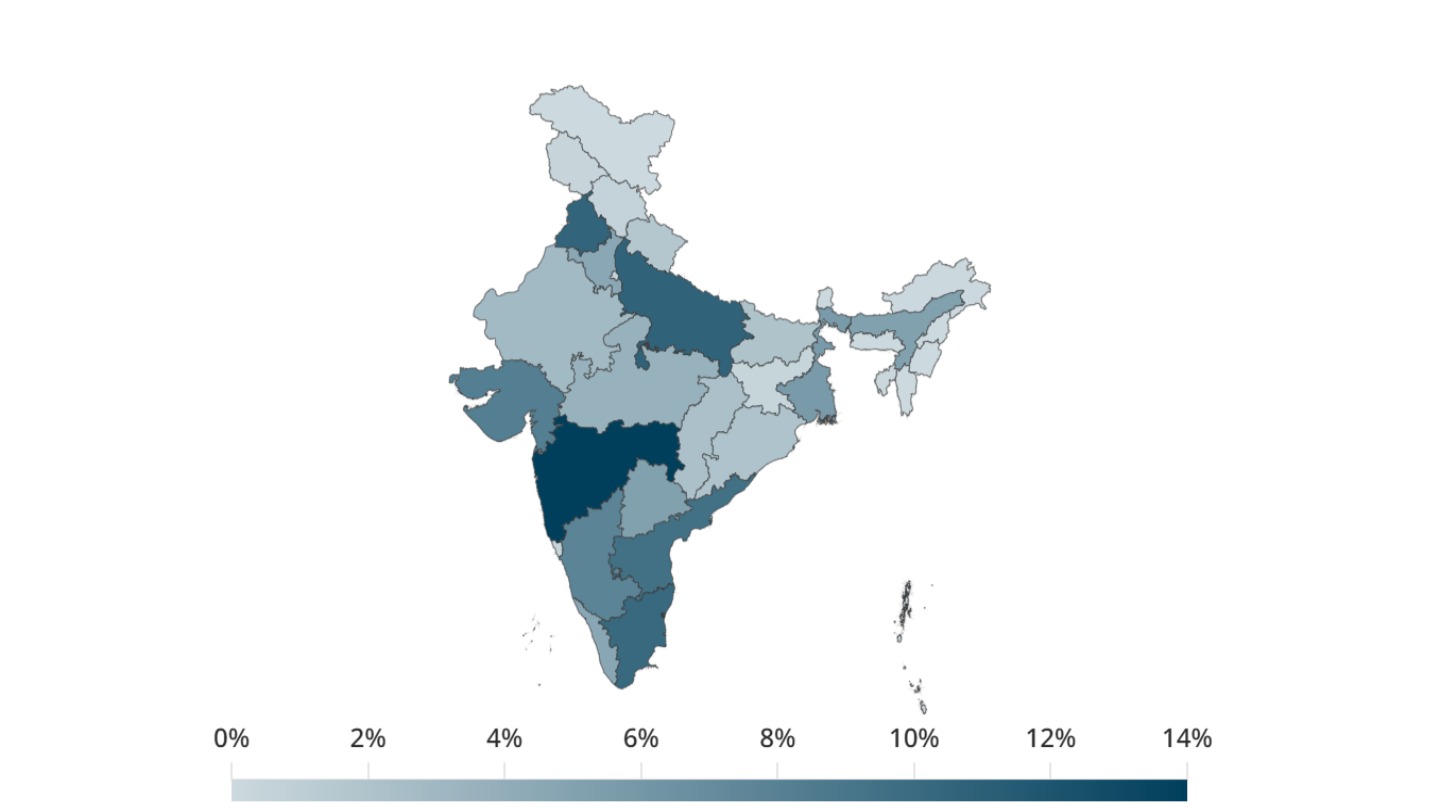

While banking access is widespread across the country, there are gender gaps in some states.

The share of men with a bank account is more than 95% in most states, but is below 90% for women in several states. Relatively more developed states including Gujarat and Maharashtra, northern states and states in the northeast still have a gender gap in banking access.

Bank account usage

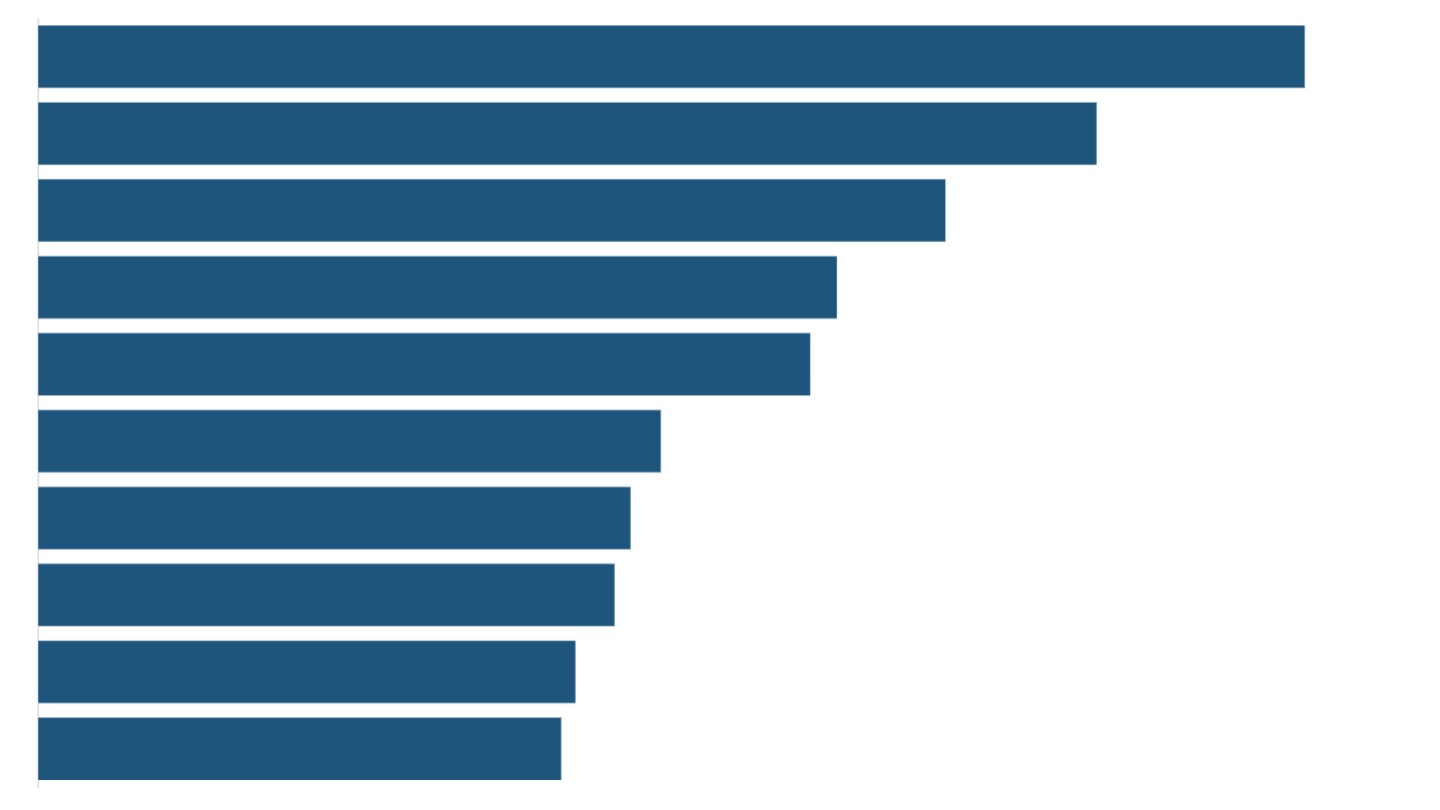

Despite most adults now having a bank account, the extent of usage could still have some way to go. By surveying a representative sample of 3,000 Indians, the World Bank's Global Findex Database found that more than a third of account-holders in India had an inactive account in 2021, meaning that they had made neither deposits nor withdrawals, nor had any incoming or outgoing digital payments in the preceding year.[4] Not having enough money in the account, distance to the bank, and lack of trust with the banking system were reported to be the key reasons Indians did not use their bank account. The share of inactive users was far higher in India than in the other surveyed developing economies.

Women were more likely to be holding inactive bank accounts. About 42% of female account owners in India were found to be having inactive accounts compared to 30% among male account owners. This gender gap was particularly large in India, the survey found.

[1] Basic Statistical Returns of Commercial Banks, Database on Indian Economy, Reserve Bank of India

[2] India's National Sample Surveys (nationally representative household surveys conducted by India's National Statistics Office) have only recently begun to ask individuals whether they have a bank account. The Comprehensive Annual Modular Survey (NSS 79th round) asks individuals whether they have "an account individually or jointly in any bank/ other financial institution/ mobile money service provider".

[3] Among the poorest 20% of adults, 89% of women and 94% of men had a bank account in 2023. The proportions were 93% for women and 98% for men in the richest quintile. Quintiles are created by arranging the adult population in ascending order of monthly per capita consumption expenditure, and dividing into five equal sized groups.

[4] Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, and Saniya Ansar. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19. Washington, DC: World Bank. The 2021 survey was conducted with 128,000 people above the age of 15 residing in 123 countries by Gallup, Inc. as a part of the Gallup World Poll. While the survey was conducted over phones in some countries due to Covid-19 restrictions, it was conducted in a face-to-face manner in India covering a sample size of 3,000 individuals. Samples in each country are nationally representative.