Retail payments in India

Over the last two decades, India has seen a decline in the use of traditional modes of payments, like cash and cheques, and an explosion in the use of digital modes of payments. However, inequities in access remain a concern

Propelled by rising mobile phone and internet access, India is seeing exponential growth in digital payments.

Indians can make retail payments - transactions made to buy goods and services - through cash and cheques.[1] They can also make digital payments through electronic fund transfers, card-based payments and mobile phone or app-based transactions.[2]

In this piece, we look at the decline in the use of traditional modes of payment in India, and the rise of retail digital payments including National Electronic Fund Transfer (NEFT), the Immediate Payments Service (IMPS), credit and debit cards, and Unified Payments Interface (UPI), which together account for daily transactions of over Rs 2.2 trillion ($25 billion).[3]

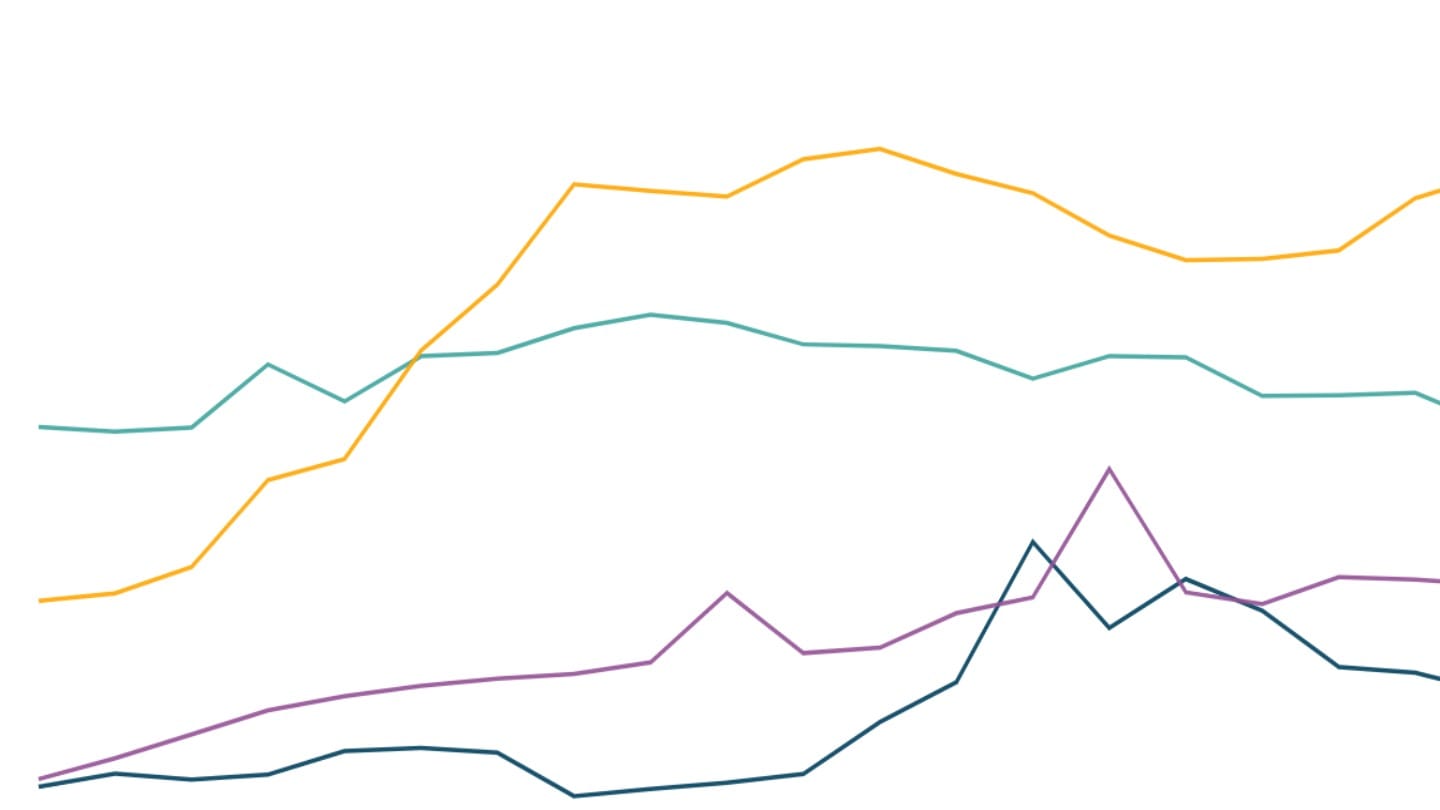

The changing face of retail payments in India

Just two decades ago, more than 95% of the money spent every month on major retail payments was made using cheques.[4]

However, since the introduction of NEFT in 2005-06 and later with the rise of UPI, digital retail payments have come to dominate, according to statistics maintained by the Reserve Bank of India, India's central bank.[5]

The rise of UPI

Driven by the rise in the use of mobile phone-based internet, the RBI finds that the average number of daily transactions via the Unified Payments Interface[6] has shot up. In the five years to 2025, the average daily number of UPI transactions grew from 40 million to 550 million per day, outstripping all other modes of digital payments.[7]

Despite being much fewer in number, the largest daily transactions by value, on the other hand, take place via NEFT.[8] From 2020 to January 2025, the average daily transaction value on NEFT doubled from Rs 600 billion to Rs 1.2 trillion.

UPI is mainly used for small peer-to-peer and peer-to-merchant payments, while NEFT is used for transactions with a larger ticket size.[9] While the average value of a UPI transaction is around Rs 1,500, that of an NEFT transaction is a little under Rs 50,000.[10]

Debit and credit cards

Despite being introduced much earlier than NEFT and UPI, debit and credit cards have grown more slowly. Registered debit cards grew in number in the first two decades of the 21st century, but have plateaued in recent years. The number of credit cards is far lower, but has been growing since the mid-2010s, doubling every five years.

There are now more than 100 million credit cards and nearly one billion debit cards[11] in India, according to RBI statistics.[12]

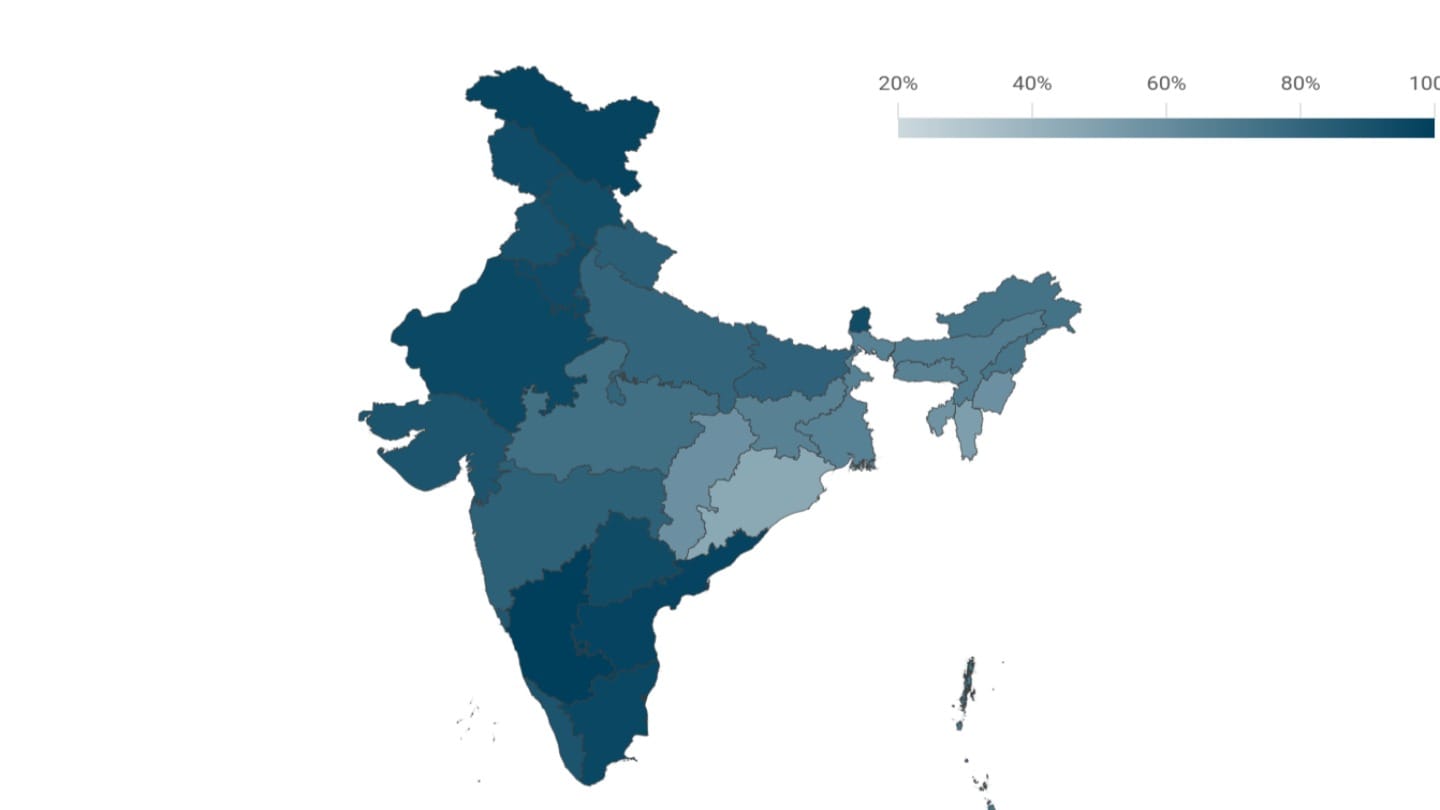

Is access to financial services equitable?

While national data is limited,[13] the Global Findex Database of the World Bank, based on a survey of more than 140,000 people in more than 135 countries, provides some insights on who in India accesses financial services.[14] The latest version gives a comparative picture of bank account ownership, card ownership, as well as card use by adults across countries, as of 2021.

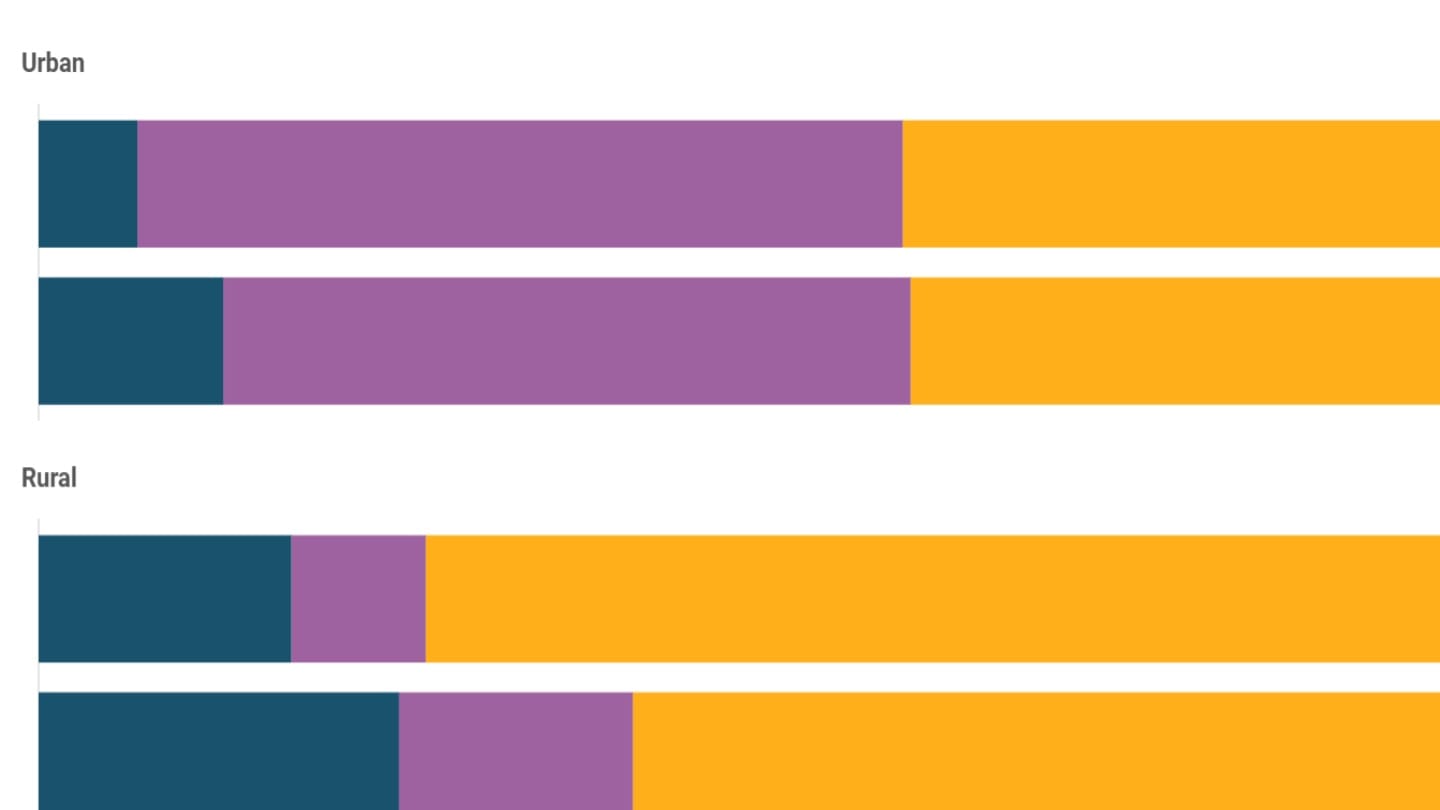

In 2021, the Findex Database found that India had high bank account ownership at roughly 80%, but low card ownership, with one in four adults reporting owning a debit card, and only 5% reporting owning a credit card.

It also found that while the gender gap in bank account ownership in India had closed by 2021, wide gender gaps still existed in debit and credit card ownership, and in making digital payments.[15]

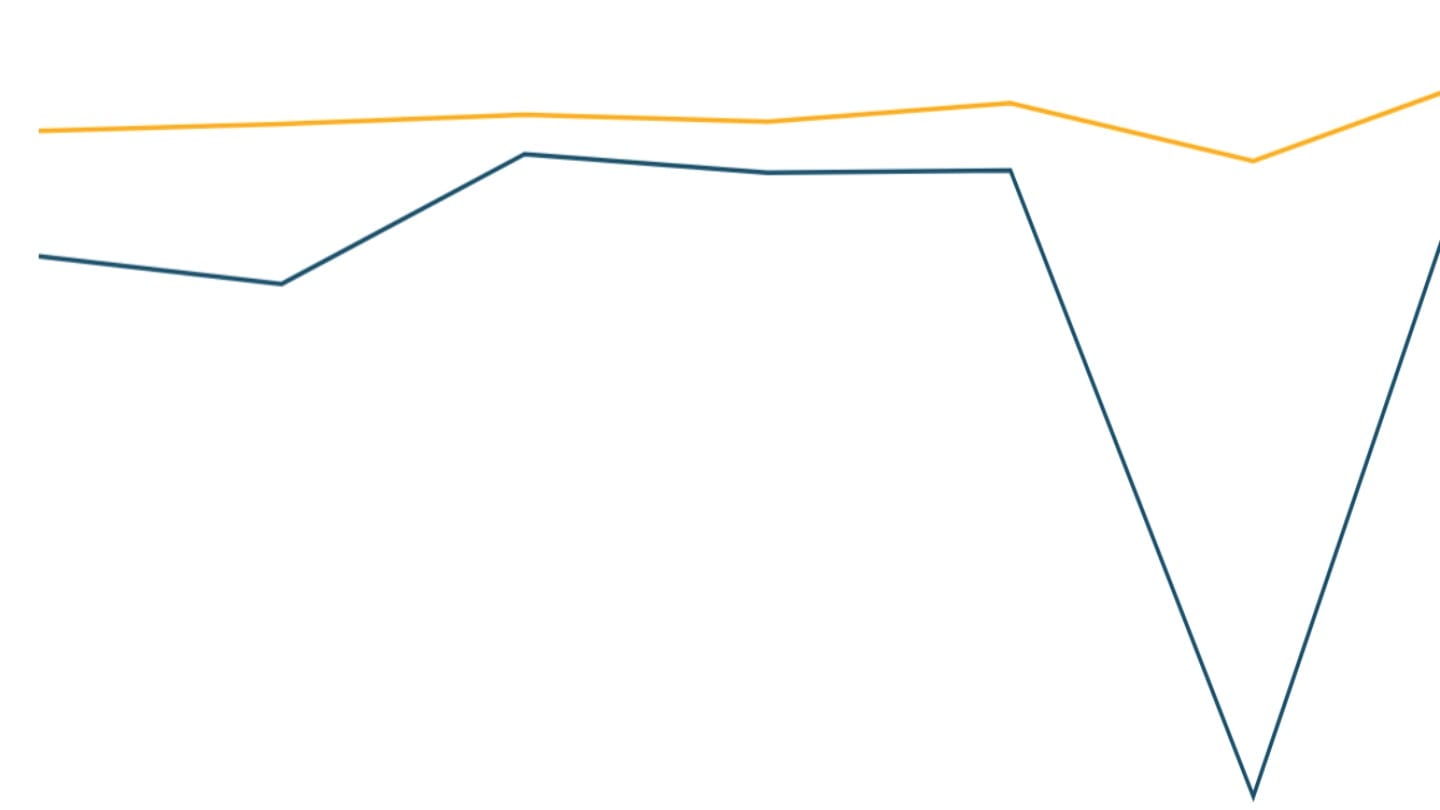

Cash

Cash was the predominant payment method in India for decades. Currency with the public spiked during the pandemic, but is now back down to being close to its historical levels, according to data from the RBI.[16]

While the share of cash in retail payments cannot be estimated, there are two indicators that suggest a decline in the role of cash.

One, the monthly withdrawals of cash from ATMs has been falling over the last few years. Research has also found that the use of cash in consumer spending declined from close to 80% in 2021 to less than 60% in 2024.[17]

Two, the share of currency in the annual financial savings of Indian households has dropped from 13% in 2019 to less than 5% in 2024.[18]

[1] Although the use of cash to make payments is declining, it still accounts for 50%-60% of household expenditure, according to "Cash Usage Indicator for India", Pradip Bhuyan, Monthly RBI Bulletin, October 2024.

[2] A digital payment mode not considered under the retail category is the Real-Time Gross Settlement (RTGS), which is mainly used by banks to transfer large amounts among themselves.

[3] Some modes of retail digital payments, such as wallets (prepaid payment instruments), BHIM Aadhaar Pay, Aadhaar Payment Bridge System, National Automated Clearing House, and others are not included in the piece since they are either a very small part of the overall mix, or are not the usual modes of retail payment available to consumers.

[4] Data source: Reserve Bank of India's statistics on Payments System Indicators. While cheques are a part of the retail payment modes in the new format of payments data, it is possible that a part of cheque payments in the past were for non-retail purposes.

[5] RBI's Currency and Finance Report, 2024 (Chapter III) states: "The share of the volume of paper clearing plummeted to 0.4 per cent in 2023-24 in total retail payments from 81.9 per cent in 2005-06. Further, the share of digital retail transactions in total value of retail payments increased to 90.9 per cent in 2023-24 from 1.3 per cent in 2005-06".

[6] Launched in 2016, India's Unified Payments Interface is a payments technology that uses mobile phone-based applications to create easy means for digital payments. The back-end is managed by the National Payments Corporation of India, a non-profit owned collectively by banks. About 200 banks are onboarded to UPI, which is now the fifth largest payments network in the world.

[7] These numbers include peer-to-peer payments and transactions between accounts held by the same person.

[8] The National Electronic Fund Transfer is one of India's key retail digital payments systems launched in 2005 for secure transfer of funds between bank accounts. The NEFT system is owned by the RBI.

[9] UPI has a daily transaction limit of Rs 100,000 for a user, but there is no upper limit on transactions via NEFT.

[10] The average value of transactions is obtained by dividing the value of transactions in the reference period by the number (volume) of transactions in the same period. The RBI maintains the monthly value and volume of transactions at the official data repository, the Database on Indian Economy.

[11] As of January 2025.

[12] A credit card is a payment instrument from a credit provider such as a bank with a pre-approved credit limit. The consumer uses the credit available with the card to make payments instantly, and they have to clear the dues within a pre-set time period. A debit card links directly to the bank account of the user and can only be used for payments where money is instantly debited from the bank account, or to withdraw cash from currency teller machines.

[13] There is only limited national household survey data on the ownership of financial products. The 2019 All India Debt and Investment Survey conducted by the National Statistics Office found that two in five Indians owned either a credit card or a debit card, with a substantial difference between men and women. Card ownership grew with income levels but the gender gap remained similar in magnitude at both ends of the economic spectrum.

[14] The survey is carried out by Gallup, an American multinational survey and advisory agency. The sample size is at least 1000 for each country with a few exceptions, and the sample size for India in the 2021 round was 3000.

[15] A sample survey conducted by the Reserve Bank of India and the National Payments Corporation of India in 2022 found that 36% of Indian consumers used digital payment modes. While half of the surveyed men said they had used a digital payment method once in their lifetime, less than a third of women said so. The findings of the survey were published in the Currency and Finance Report, 2024.

[16] Currency with the public was at a level of 11.3% of the gross domestic product in 2023-24. It was at a similar level for a decade before the demonetisation of high denomination notes in 2016. From 2016 to date, demonetisation and the pandemic had disruptive effects on cash in circulation.

[17] "Cash Usage Indicator for India", Pradip Bhuyan, Monthly RBI Bulletin, October 2024. Consumer spending, or private final consumption expenditure, forms the bulk of India's GDP, occupying a share of about 60% in it. GDP or the components of it represent the value generated in the economy, very different from payments or transactions, which could be done multiple times over but may not always add up to the GDP.

[18] The Reserve Bank of India measures the annual flow of financial assets and liabilities of Indian households. Data from 2019-20 to 2023-24 can be found here.